Simple vs. Compound Interest How to Tell the Difference

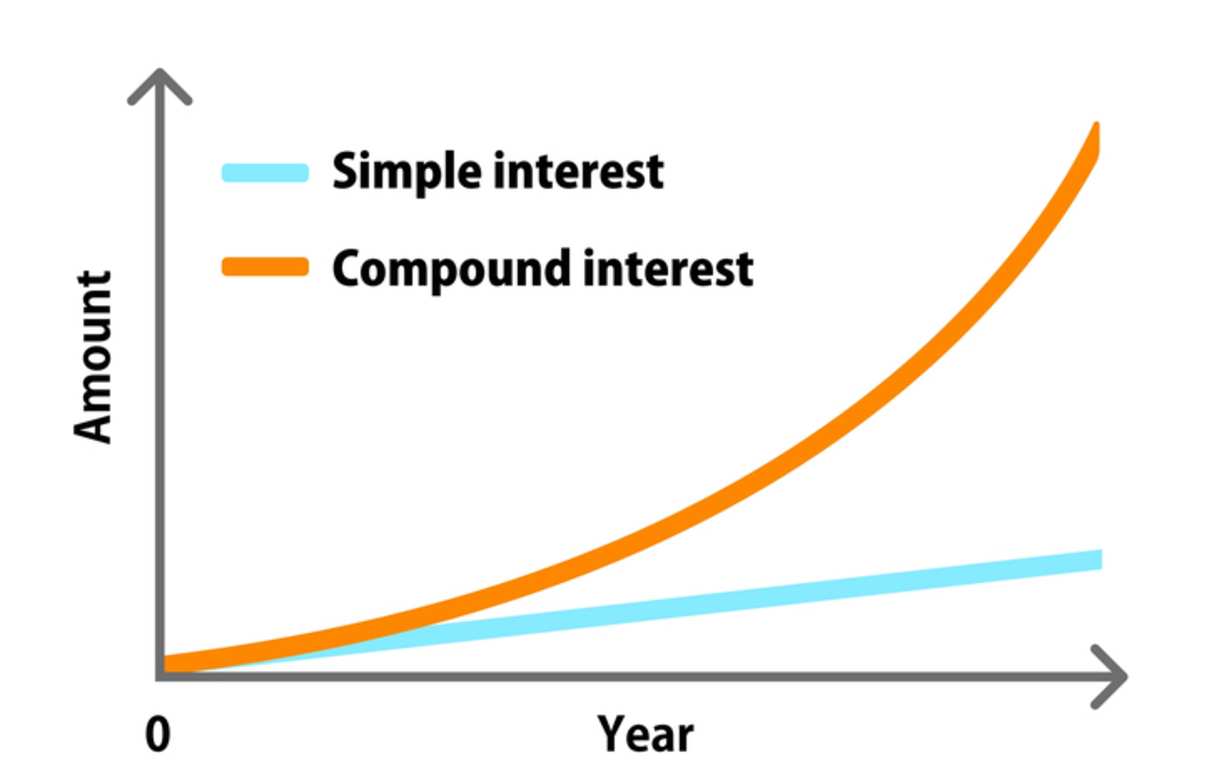

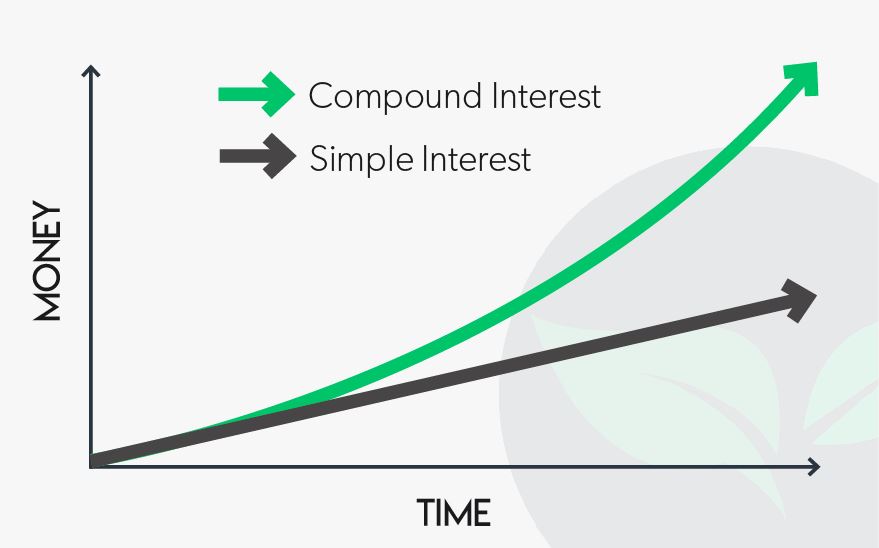

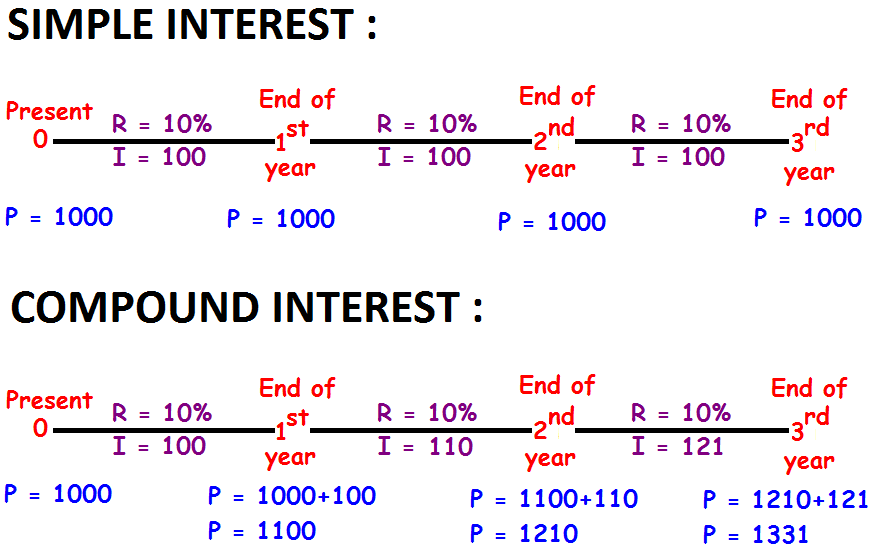

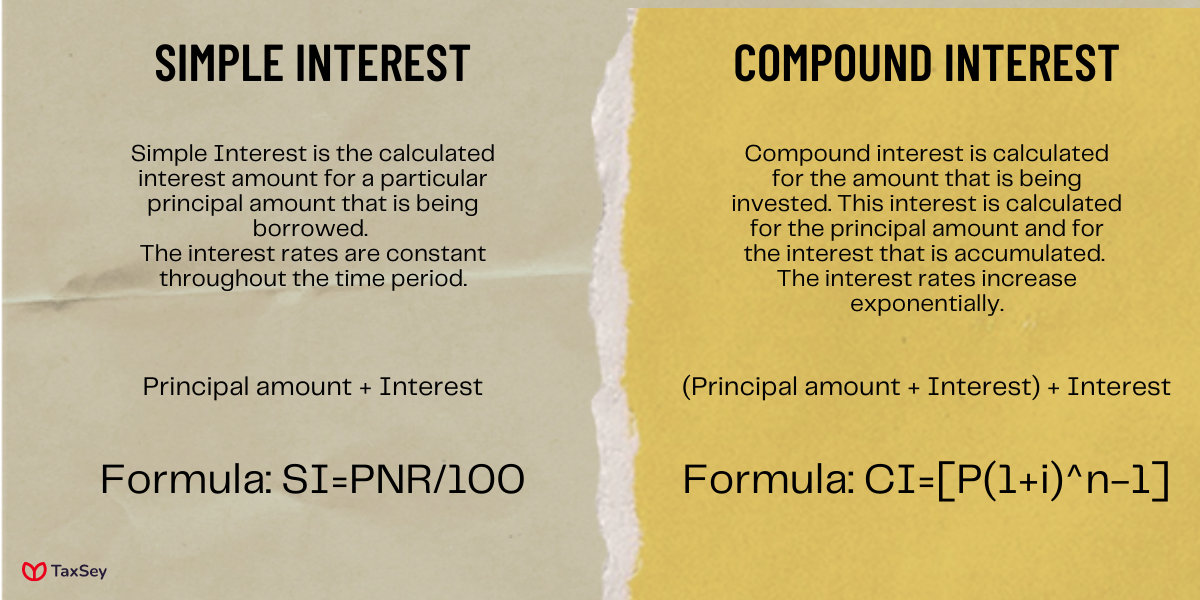

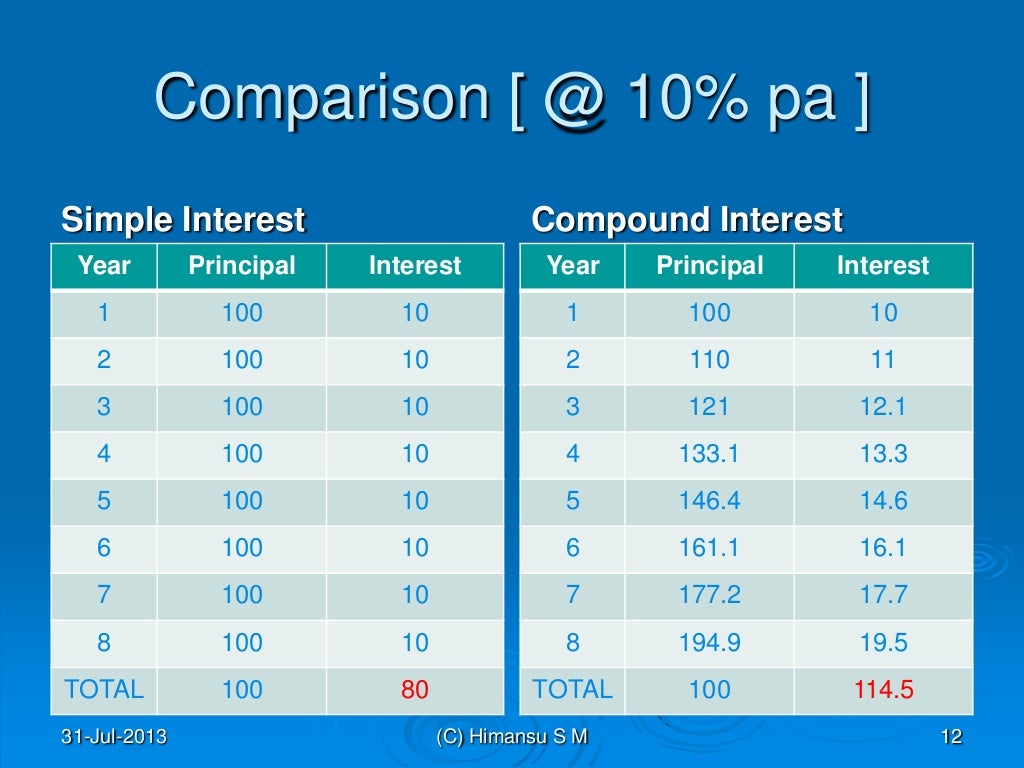

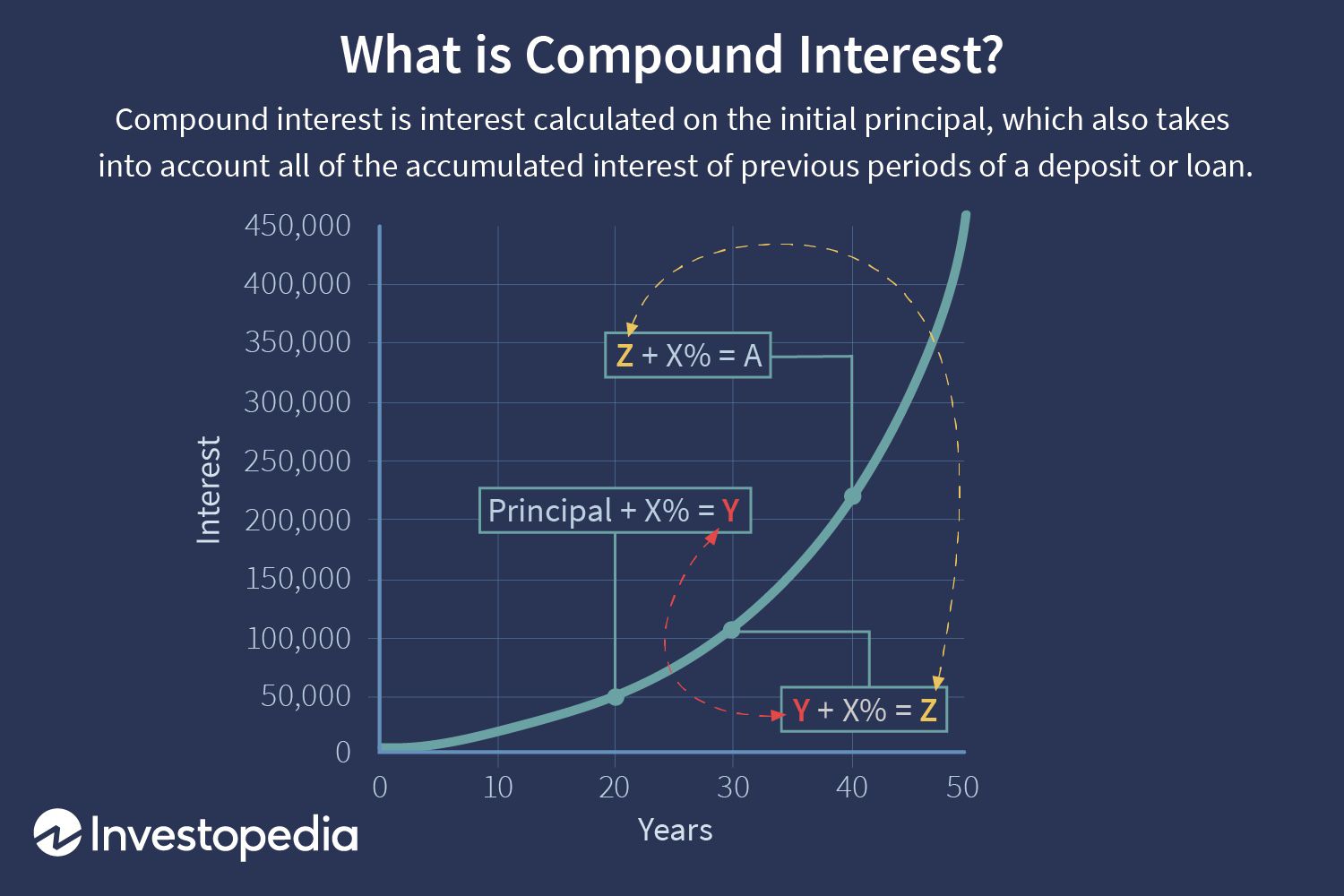

Simple interest and compound interest are key financial concepts when it comes to borrowing, saving and investing money. Simply put, simple interest and compound interest are two different ways of calculating the interest owed on a loan or the interest earned on savings or investments. As it relates to loans, simple interest refers to the amount of interest paid on the principal, or original.. Compound Interest. Compound Interest is calculated on the principal amount and also on the interest of previous periods. The following formula can be used to find out the compound interest: A = P× (1 + r/n) nt. Where, A = final amount including interest, P = principal amount, r = annual interest rate (as decimal), n = number of compounds per.

Simple interest vs. Compound interest (EasytoUnderstand Explanations) YouTube

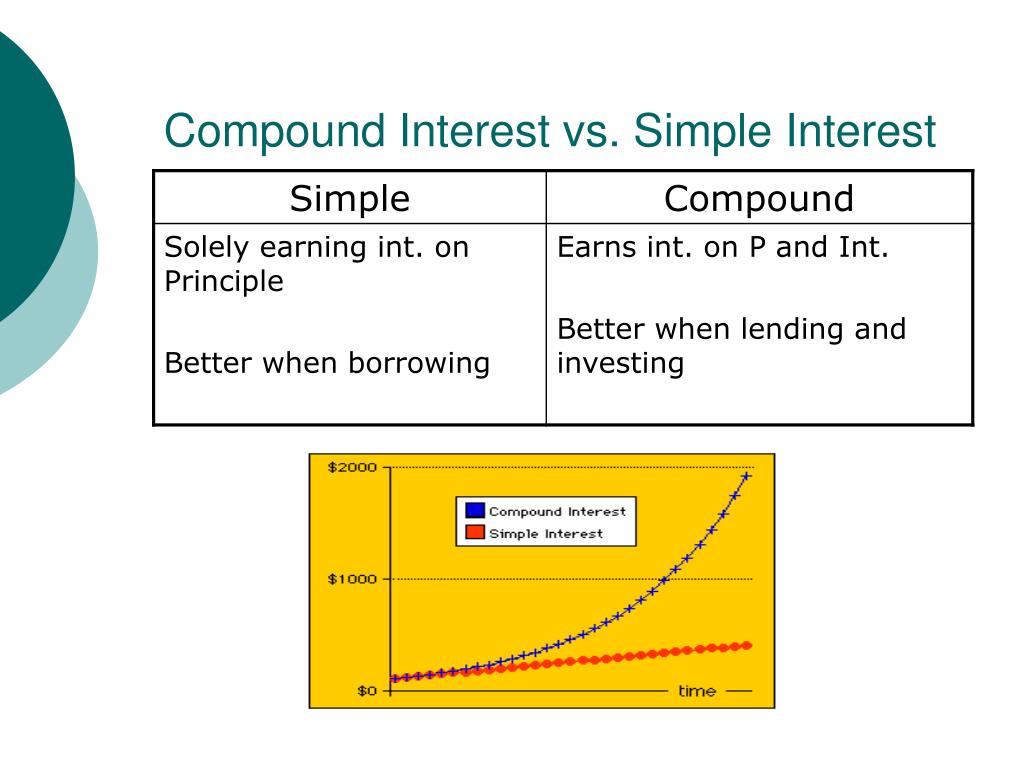

Simple Interest vs. Compound Interest What’s The Difference In Tabular Form, Points

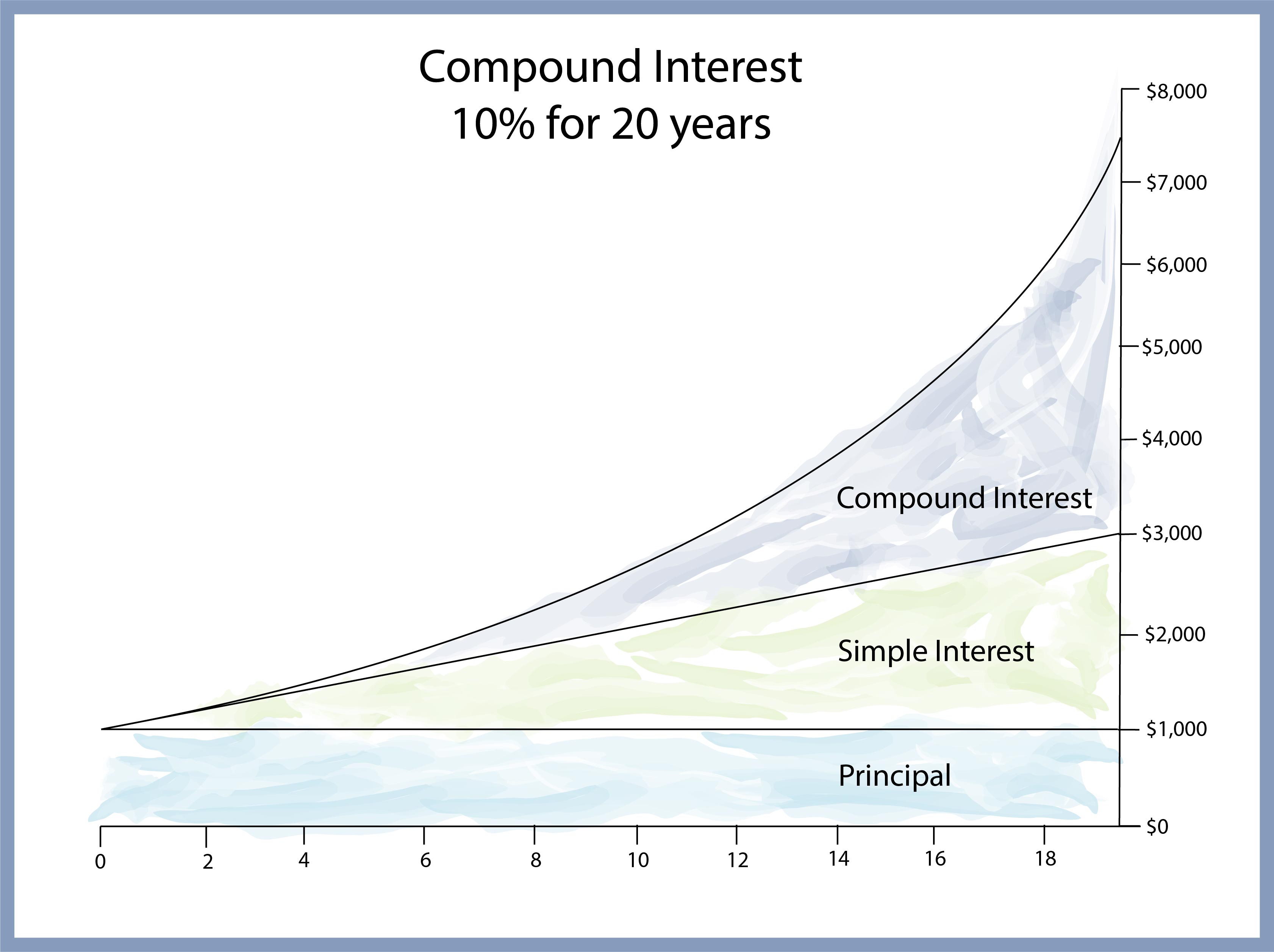

Compound Interest Chart

Simple interest vs Compound interest Differences and Definitions MakeMoney.ng

Simple vs. Compound Interest How to Tell the Difference

:max_bytes(150000):strip_icc()/dotdash-how-can-i-tell-if-loan-uses-simple-or-compound-interest-Final-17d192dbebc1467cad0e73f776fa7ffd.jpg)

Simple Interest vs. Compound Interest

Different Types Of Interest

Compound Interest How to use the Effect Correctly GELVOS

Compound Interest

Finance Affairs Blog Finance Affairs

Financial Terms from AZ CNBconnect

Simple and Compound Interest

PPT Compound Interest Finance 321 Professor D’Arcy PowerPoint Presentation ID6787592

Formula Of Compound Interest Rate pametno

Learn about Simple interest and Compound interest

Compound interest How it can be your friend or your enemy

Simple Interest vs. Compound Interest Which One is Better?

Simple and Compound Interest

The Power of Compound Interest Shift Realty Puerto Rico

The formula for calculating simple interest is quite straightforward: Simple Interest = Principal * Annual Interest Rate * Time. It’s calculated on the initial principal amount without considering the interest that accumulates over time. In contrast, the compound interest formula is more complex: Compound Interest = Principal * (1 + Annual.. Interest paid = Principal x Interest rate x Time period. For example, let’s say you take out a $10,000 loan with an interest rate of 10% per year and a loan term of five years. To get the total.